A Save3ABN Exclusive

How to Turn $6,139 into $135,000 in Just 7 Days???

7 Simple Steps to Easy Money???

This topic concerns real estate transactions from the year 1998, transactions regarding a piece of property

identified as "Lot 6" in the legal description, a piece of property that at one time was the Shelton home.

Scans of the actual documents in question appear at the bottom of this web page.

Step 1: Non-Profit Buys "Lot 6"

A number of things transpired prior to the start of those allegedly highly profitable 7 days of September 25

through October 2, 1998. As the story goes, philanthropist May Chung either put up the money for 3ABN

to buy "Lot 6," as suggested by one of the documents below, or bought "Lot 6" and deeded it to

3ABN.

Step 2: Non-Profit Grants Life Estate

The next step to an alleged $129,000 profit in 7 days was for 3ABN president Danny Shelton, his then wife

and 3ABN corporation secretary Linda Shelton, and philanthropist May Chung to receive a life estate in "Lot 6,"

allowing them to use this 3ABN property as long as they lived.

|

98–1104

CORPORATE RESOLUTION

TO WHOM IT MAY CONCERN:

This is to certify that Linda S. Shelton is the duly qualified

and elected Secretary, and Walter C. Thompson is the duly qualified

and elected Chairman of the Board of Directors of THREE ANGELS

BROADCASTING NETWORK, INC., a corporation, of the City of West

Frankfort, County of Franklin and State of Illinois, and that

at a regular meeting of the Board of Directors, held on September

15, 1996, the following action was taken and recorded in the

minutes of said corporation, of which action, this is a true

copy, to-wit:

15) It was voted to convey a life estate to Danny L. Shelton,

Linda S. Shelton and May Chung, or the survivors and/or survivor

of them, on the property located at Route 3, Box 10, in Thompsonville,

as provided in the original gift that provided for the purchase of the property, and to

authorize the officers to sign the deed for conveyance purposes. Said property

is legally described as follows:

Lot Six (6) in Surveyor's Plat of the Northeast Quarter (NE 1/4) of Section

Sixteen (16), Township Seven (7) South, Range Four (4) East of the Third

Principal Meridian, except the coal, oil, gas and other minerals underlying

the same, situated in Franklin County, Illinois.

The records of THREE ANGELS BROADCASTING NETWORK, INC. disclose

that Danny L. Shelton is the President, and Linda S. Shelton

is the Secretary, and Walter C. Thompson is Chairman of the Board

of Directors.

|

|

THREE ANGELS BROADCASTING

NETWORK, INC.

|

|

Dated: February 18 , 1998.

|

By:

|

[Signed]

| |

|

|

Walter C. Thompson

Board Chairman

|

|

Dated: February 16 , 1998.

|

By:

|

[Signed]

| |

|

|

Linda S. Shelton

Corporation Secretary/p>

|

Page -1- CORPORATION RESOLUTION

Page 3 of 3

|

If May Chung really was the one who put up the money to buy "Lot 6," why were the Sheltons given a life estate in

"Lot 6" too?

And what exactly does it mean for the officers to be authorized "to sign the deed for conveyance purposes"

in connection with a vote "to convey a life estate to Danny L. Shelton"? When someone is granted a life estate

by an organization, there is no need to sign a deed, as we point out below.

Step 3: Non-Profit Deeds "Lot 6"

Now is where things really start getting a bit strange: In February 1998, "Lot 6" is titled in Danny, Linda, and

May's names because of their life estate, almost a year and a half after they were allegedly given that life

estate by the 3ABN Board. If the 3ABN Board really voted in September 1996 to authorize the officers to

"convey" the property to Danny by signing a deed, why did they wait a year and a half to do it?

We have consulted a number of real estate and trust services experts, and each tells us that when you

receive a life estate, you never have the property titled in your name. Was "Lot 6"

deeded to Danny Shelton in February just so that he could sell the property at a substantial profit in October?

|

(Life Estate only)

WARRANTY DEED - JOINT TENANCY

THE GRANTORS, THREE ANGELS BROADCASTING

NETWORK, INC., a corporation, of 3391

Charley Good Road, West Frankfort,

County of Franklin and State of Illinois

for and in consideration of Ten Dollars ($10) O.V.C. Dollar in

hand paid, Conveys and warrants to DANNY L. SHELTON, LINDA S.

SHELTON, and MAY CHUNG, not as tenancy in common but in JOINT

TENANCY, the following described real estate:

A life estate only for the lifetime of DANNY L. SHELTON and LINDA

S. SHELTON, husband and wife, and MAY CHUNG, or the survivors/survivor

of them, in the following property:

Lot Six (6) in Surveyor's Plat of the Northeast Quarter (NE

1/4) of Section Sixteen (16), Township Seven (7) South, Range

Four (4) East of the Third Principal Meridian, except the coal,

oil, gas and other minerals underlying the same, situated in

Franklin County, Illinois.

situated in the County of Franklin, in the State of Illinois,

hereby releasing and waiving all rights and under and by virtue

of the Homestead Exemption Laws of this State.

Dated February 16 , 1998.

|

|

|

THREE ANGELS BROADCASTING

NETWORK, INC.

| |

Attested By:

[Signed]

Walter C. Thompson

Board Chairman, 3ABN

|

|

By:

|

[Signed]

Danny L. Shelton, President

|

By:

|

[Signed]

Linda S. Shelton, Secretary

|

|

DEED PREPARED BY:

|

Herald Follett, Attorney

P.O. Box 3092

Portland, Oregon 97208

|

Page -1- WARRANTY DEED - JOINT TENANCY

(See copy of Corporate Resolution attached hereto)

PAGE 1 OF 3

|

Step 4: Philanthropist Surrenders Life Estate

At the time of Danny's allegedly super-profitable sale on October 2, 1998, he would have had to split his profits

with May Chung, unless he could get her off the title of "Lot 6" before that point. And thus on August 24,

1998, just 6 months after her name got on the title, May Chung's name is off again.

Kind of odd, isn't it, that May Chung would have been given a life estate in a property in Illinois,

and then deeded that property, if all the while she remained a resident of San Bernardino, California, as the

deed below suggests? And why put her name on the title of "Lot 6" at all if she was only going to be

on for six months?

WARRANTY DEED

THE GRANTOR, MAY CHUNG

of 155 Manchester Lane

San Bernardino, CA 92408

for and in consideration of Ten Dollars ($10.00) O.V.C. Dollar

in hand paid, Grantor conveys and warrants to THREE ANGELS BROADCASTING

NETWORK, INC., a Corporation, all of Grantor's interest in the

following described real estate:

Grantor's life estate for her lifetime, and any survivorship

rights she may have related to the interest of Danny L. Shelton

and Linda S. Shelton, or the survivor of them, in the following property:

Lot Six (6) in Surveyor's Plat of the Northeast Quarter (NE

1/4) of Section Sixteen (16), Township Seven (7) South, Range

Four (4) East of the Third Principal Meridian, except the coal,

oil, gas and other minerals underlying the same, situated in

the County of Franklin, and State of Illinois,

hereby further releasing and waiving all rights in and under

by virtue of the Homestead Exemption Laws of this State.

Dated August 24, 1998.

|

|

[Signed]

May Chung

| |

Attested By:

[Signed, Herald Follett]

| |

|

Approved and consented to by:

[Signed]

Danny L. Shelton, President

[Signed]

Linda S. Shelton, Secretary

|

|

Step 5: Non-Profit Surrenders Interest for $6,139

It is this transaction that raises a lot of questions. What it appears from the deed is that the Sheltons

in essence bought "Lot 6" in September 1998 for a mere $6,139, just one week before they sold it to Elora Ford

for $135,000. Now the fact that $6,139 is below fair market value raises some serious tax questions.

- Was the total consideration given by the Sheltons to 3ABN for "Lot 6" really only $6,139?

- Did the total consideration given for "Lot 6," even if more than $6,139, fall below fair market value?

- If so, does this real estate transaction constitute "private inurement"?

- If it does, will the IRS revoke 3ABN's tax exempt status, or have all applicable statutes of limitations run out?

- If 3ABN's tax exempt status is revoked, will the IRS assess some of 3ABN's donors for back taxes?

In case you haven't caught on, the IRS does not allow non-profit organizations to give away property at prices below

market value for the benefit of private citizens. Doing so can jeopardize that organization's tax exempt status.

And the loss of tax exempt status can affect donors retroactively, particularly if donations were given in bad

faith.

While the IRS is highly unlikely to go after small donors, some of 3ABN's larger donors will

undoubtedly breathe a lot easier if the IRS decides that there are no tax implications to the deed below.

And since we are talking about something that happened in 1998, the typical statute of limitations for

such things has most likely run out.

WARRANTY DEED

THE GRANTOR, Three Angels Broadcasting Networks, Inc.

3391 Charley Good Road

West Frankfort, Illinois 62896-0220,

for and in consideration of Six thousand one hundred thirty nine

and no/100 ($6,139.00) Dollars, O.V.C. Dollar in hand paid,

Grantor conveys and warrants to Danny L. Shelton and Linda S.

Shelton, husband and wife, all of Grantor's interest in the following

described real estate:

Lot Six (6) in Surveyor's Plat of the Northeast Quarter (NE

1/4) of Section Sixteen (16), Township Seven (7) South, Range

Four (4) East of the Third Principal Meridian, except the coal,

oil, gas and other minerals underlying the same, situated in

the County of Franklin, and State of Illinois,

(Note: This deed is given for the purpose of the Grantor

conveying its remainder interest in said property to the Grantees

herein, Danny L. Shelton and Linda S. Shelton, who at the date

of this transfer have a life estate in said property.)

hereby further releasing and waiving all rights in and under

by virtue of the Homestead Exemption Laws of this State.

Dated 9/25 ,1998.

|

|

|

Three Angels Broadcasting Network, Inc.

|

By:

|

[Signed]

Danny L. Shelton, President

|

By:

|

[Signed]

Linda S. Shelton, Secretary

|

| |

Attested By:

[Signed]

Walter C. Thompson

Chairman of the Board of Directors

|

|

Step 6: The Sheltons Sell Property for $135,000

First, here is the deed that governed the sale of the property, a deed prepared by D. Michael Riva, the

same attorney that sent those nasty cease and desist letters to

Pastor Glenn Dryden and to the Church Board

of the Community Church of God in Dunn Loring, Virginia:

WARRANTY DEED

ILLINOIS STATUTORY

MAIL TO:

ELORA L. FORD, Trustee

2804 NEW LAKE ROAD

WEST FRANKFORT IL 62896

NAME & ADDRESS OF TAXPAYERS:

ELORA L. FORD, Trustee

2804 NEW LAKE ROAD

WEST FRANKFORT 62896

|

THE GRANTORS, DANNY L. SHELTON and LINDA S. SHELTON, Husband

and Wife each in their own right and as spouse of the other,

of the City of Thompsonville, County of Franklin, State of Illinois,

for and in consideration of the sum of TEN DOLLARS ($10.00),

AND OTHER GOOD AND VALUABLE CONSIDERATION, in hand paid, the

receipt of which is hereby acknowledged, CONVEY and WARRANT TO:

ELORA L. FORD, as Trustee of THE FORD FAMILY TRUST established

by the provisions of THE FORD REVOCABLE TRUST Agreement dated

September 23, 1992, of West Frankfort, Franklin County, Illinois,

all interest in the following described Real Estate situated

in the County of Franklin, State of Illinois, to-wit:

LOT SIX (6) IN SURVEYOR'S PLAT OF THE NORTHEAST QUARTER (NE 1/4) OF

SECTION 16 TOWNSHIP 7 SOUTH RANGE 4 EAST OF THE THIRD PRINCIPAL

MERIDIAN EXCEPT THE COAL OIL, GAS AND OTHER MINERALS UNDERLYING

THE SAME, SITUATED IN FRANKLIN COUNTY, ILLINOIS.

hereby releasing and waiving all rights under and by virtue of

the Homestead Exemption Laws of the State of Illinois.

D. MICHAEL RIVA, AS PREPARER OF THIS DEED, HAS MADE NO INVESTIGATION CONCERNING ANY

POSSIBLE VIOLATIONS OF ANY ENVIRONMENTAL LAWS OR REGULATIONS INCLUDING, BUT NOT LIMITED TO, THE ILLINOIS

RESPONSIBLE TRANSFER ACT; AND THE PARTIES OF THIS DEED, BY VIRTUE OF THEIR EXECUTION, DELIVERY AND/OR ACCEPTANCE,

ACKNOWLEDGE THAT THEY HAVE READ THE FOREGOING AND ACKNOWLEDGE THAT D. MICHAEL RIVA, HAS NOT BEEN ASKED TO

REPRESENT AND/OR ADVISE THEM IN ANY WAY CONCERNING SUCH LAWS AND REGULATIONS; AND FURTHER ACKNOWLEDGE THAT SHOULD

THIS REAL ESTATE BE GOVERNED BY, OR SUBJECT TO, SUCH LAWS AND REGULATIONS, THAT SUCH COULD YIELD VERY SUBSTANTIAL

DAMAGES AND PENALTIES TO THE PARTIES.

Permanent Index Number:

Property Address: 2804 New Lake Road, West Frankfort IL 62896

|

DATED October 2 , 1998.

|

|

[Signed] (SEAL)

Danny L. Shelton

|

[Signed] (SEAL)

Linda S. Shelton

|

|

See the Real Estate Transfer Tax stamp above with the amount $202.50 in it? That consists of 0.15% of the total

consideration of $135,000 the Sheltons paid, 0.10% which goes to the State of Illinois and 0.05% which goes to

Franklin County:

|

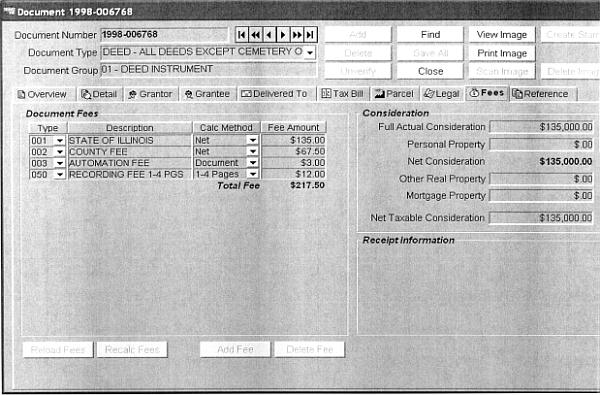

Document Fees

| Type |

Description |

Calc Method |

Fee Amount |

| 001 |

STATE OF ILLINOIS |

Net |

$135.00 |

| 002 |

COUNTY FEE |

Net |

$67.50 |

| 003 |

AUTOMATION FEE |

Document |

$3.00 |

| 004 |

RECORDING FEE 1-4 PGS |

1-4 Pages |

$12.00 |

| |

Total Fee $217.50 |

Consideration

| Full Actual Consideration |

$135,000.00 |

| Personal Property |

$.00 |

| Net Consideration |

$135,000.00 |

| Other Real Property |

$.00 |

| Mortgage Property |

$.00 |

| Net Taxable Consideration |

$135,000.00 |

|

|

Other Comments and Questions

1998 was allegedly a very profitable year for Danny Shelton, not just because of "Lot 6."

Below you will find a June 1998 real estate transaction in which Elora Ford gave Danny a gift of

the 18 acres upon which his present house sits. No real estate

transfer taxes were paid due to what looks like paragraph "e" of "Section 35 ILCS 200/31-45,"

a paragraph which states that no transfer taxes have to be paid if the total consideration given is less than $100.

Speaking of taxes, it is interesting that the February 1998 deed claimed that the board action granting

Danny a life estate in "Lot 6" was taken in September 1996. Was Danny trying to avoid taxes on short-term capital gains

by holding the property for more than two years? But then, since the property apparently did not actually become his

until September 25, 1998, and he sold it on October 2 just one week later, wouldn't there be no way to say that

he owned "Lot 6" for two years?

- Did Danny Shelton report this profit on his 1998 tax return?

- If so, did he report it as a short-term or as a long-term capital gain?

- Did 3ABN report their "gift" of "Lot 6" to Danny on his W-2?

- Did 3ABN also report it on their 1998

Form 990 as part of their compensation to Danny?

|